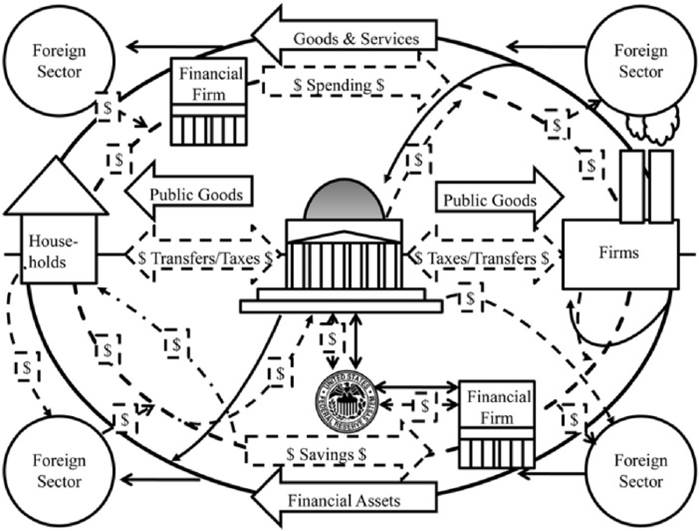

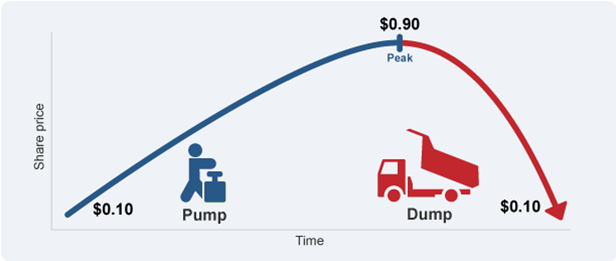

The Market that Cannot Be ManipulatedFebruary 17, 2020 The manipulation of all types of financial markets has a long and sordid history. From the Tulip Mania of the 1600s to the current stock market bubble, market manipulators have used many strategies to target unwary investors. Fortunately, there is one type of market that cannot be manipulated. The manipulation of all types of financial markets has a long and sordid history. From the Tulip Mania of the 1600s to the current stock market bubble, market manipulators have used many strategies to target unwary investors. Fortunately, there is one type of market that cannot be manipulated.Imagine finding a bunch of baseball cards in a drawer and discovering that they are worth $1 Million! One elderly lady did. Baseball cards and dozens of types of collectibles have outperformed traditional financial markets for hundreds of years. But there is one type of collectible that is more sought-after by both collectors and investors because it has the most potential profit. Almost every wealthy family owns this type of collectible. Now regular people can own them as well.  Buyer Beware In my 40 plus years of investing and serving as the financial advisor for individuals, companies, and large ministries, I have seen investors lose huge amounts of money because they didn't listen to sound advice and tried to invest in the financial markets on their own. Some lost every penny; others lost most of their retirement funds. Many professionals had to postpone retirement and now work as greeters at Walmart. Over time, 90% to 95% of individual investors lose money when they try to trade their own accounts. So perhaps we should all buy mutual funds. Or perhaps not. It turns out that the great majority of mutual funds do worse than the market averages in any given year. Doing thorough research, purchasing great stocks, and using protective stops is probably the best way to try to make money in stocks. (Protective stops trigger the automatic sale of a stock if it drops a specified amount – usually 10%.) But the "experts" who manage your money in your annuity, 401K, IRA, or pension plan put it all into mutual funds. Why? Because they're too lazy to do it the right way. In the Financial Panic of 2008 retirees lost 40% to 50% of their money. If their financial “experts” had used the method described above, they wouldn’t have lost more than 10% Can be Hard to Understand  The financial markets are hard to understand. To be really good at selecting stocks, setting up your stocks, and developing an exit strategy you may need to spend years studying. After you have learned all you can, the real learning begins - you start "paper trading." Until you are successful trading or investing fake money, you shouldn't put a dime in any market. The financial markets are hard to understand. To be really good at selecting stocks, setting up your stocks, and developing an exit strategy you may need to spend years studying. After you have learned all you can, the real learning begins - you start "paper trading." Until you are successful trading or investing fake money, you shouldn't put a dime in any market.Don't get suckered by the hucksters that promise you investing success if you will just give them $5,000 for a three-day course. That is ridiculous, as you will soon discover. So before the course ends, the excellent instructors (who are actually excellent salesmen) will convince many attendees to take the Intermediate course for only $15,000. Then of course if you're really smart (or really dumb) you will pay them $30,000 for the Advanced class. After all, you're going to be making hundreds of thousands of dollars, so why not? If you're not bankrupt by then, they will try to get you to sign up for individual "coaching." This is a one-on-one opportunity for them to try to up-sell you even more. Because the financial markets are hard to understand the few people who profit from the stock market study hard on their own, learn to understand the markets they trade, paper trade, and then always use protection (stops) whenthey start trading with real money. Market Manipulation This is defined as a deliberate attempt to interfere with the free and fair operation of a market, and the creation of false or misleading appearances concerning the price of, or market for, a security, currency or commodity. Markets that Are Now or Have been Manipulated 1) Stocks 2) Options 3) Mutual Funds 4) Bonds 5) Commodities 6) Annuities 7) Energy 8) MBS's 9) CDO's 10) Currencies 11) Real Estate 12) Bullion Pump & Dump  This is defined as the artificial inflation of a stock's price to make profits on the sale of shares bought before "pumping" them. Pump & dump is illegal and can lead to hefty fines and even time in prison. The victims often lose a large percentage or all of their investment, since the stock usually goes back to its original price (or even lower) after the scam is complete. This is defined as the artificial inflation of a stock's price to make profits on the sale of shares bought before "pumping" them. Pump & dump is illegal and can lead to hefty fines and even time in prison. The victims often lose a large percentage or all of their investment, since the stock usually goes back to its original price (or even lower) after the scam is complete.Here is how it is done: Take a large position in a company’s stock before starting to “pump” it up. Boost the price of the stock through recommendations based on false, misleading, or greatly exaggerated claims. "Dump" (sell positions) after the hype has led to a higher share price. Repeat steps 1, 2 & 3. In the past, this was accomplished with telephone "boiler rooms" that would "cold call" a prospect. But since Al Gore invented the Internet, Pump & Dump has gained a new life. The scam usually targets micro- & small-cap stocks, since they are the easiest to manipulate. Due to the small float of these stocks, it only takes a small number of new buyers to pump a stock up. Always take claims that a stock is about to "break out" with a very large grain of salt (or perhaps a whole salt shaker). Anyone who listens to Internet "gurus" is asking to be fleeced.  Jim Cramer – Mad Money Jim Cramer – Mad Money In a teleision interview, self-proclaimed stock guru Jim Cramer described strategies used by hedge fund managers to manipulate stock prices - some of questionable legality, & others clearly illegal. He described himself as a master manipulator. He described said he could push stocks higher or lower with as little as $5 million in capital when he ran his hedge fund. Cramer admitted, "A lot of times I was short at my hedge fund (meaning I needed a stock to go down). So I would create a level of activity beforehand that could drive the futures." He also encouraged other hedge funds to engage in this type of questionable activity because it is "a very quick way to make money."  Railroad Manipulation Railroad ManipulationIn 1867, American financier & railroad builder Jay Gould was on the board of directors of the Erie Railroad. In what became known as The Erie War, Gould issued 100,000 shares of new Erie stock by illegally converting debentures. He used the money to bribe New York legislators to make the conversion legal. Outfoxed, Vanderbilt settled & got a $1 Million sweetener. Gould greatly expanded Erie's debt & launched an expansion campaign. He sold its stock short & made a killing before bankrupting Erie in 1875. Energy Manipulation After merging two gas pipeline companies to form Enron Company in 1985, con artist Ken Lay lobbied Congress to deregulate the sale of natural gas. Enron began trading the energy markets to drive up prices and significantly increase its revenue. Lay & CEO Jeff Skilling used accounting loopholes to keep billions in debt off the books. Their biggest con was pressuring Arthur Anderson & Company staffers to help them fool the board of directors & audit committees.  The Enron Meltdown The Enron MeltdownInvestors lost more than $70 billion when Enron became one of the biggest bankruptcies in history. Enron's stock price dove from a high of $90 in mid-2000 to less than $1 by the end of November 2001. Their accounting firm, Anderson, was one of the top five accounting companies in the world. As a result of being scammed by Enron, it lost most of its customers & shut down. It used to take rooms full of stockbrokers feverishly working massive phone banks to manipulate a company's shares. Now, using the Internet, anyone can reach millions of traders instantly, while remaining completely anonymous. Example of an Internet Swindle  Two Arab college students in California spent two weeks acquiring 97% of the thinly traded stock of NEI Webworld Inc. for pennies per share. After the market closed on a Friday, they sent out hundreds of messages on Internet bulletin boards touting a takeover with huge profits on the horizon. The next Monday, based on orders made by traders who believed the fake postings over the weekend, the stock rose 106,600% to $15.50 a share – in 30 minutes! The students sold their shares into the buying frenzy and eventually bagged over $350,000 in profits. NEI shares closed that day at 75 cents. Both students were arrested and convicted of felonies. Two Arab college students in California spent two weeks acquiring 97% of the thinly traded stock of NEI Webworld Inc. for pennies per share. After the market closed on a Friday, they sent out hundreds of messages on Internet bulletin boards touting a takeover with huge profits on the horizon. The next Monday, based on orders made by traders who believed the fake postings over the weekend, the stock rose 106,600% to $15.50 a share – in 30 minutes! The students sold their shares into the buying frenzy and eventually bagged over $350,000 in profits. NEI shares closed that day at 75 cents. Both students were arrested and convicted of felonies.Tulpenwoede - Tulip Mania and Madness  This was one of the most famous market bubbles of all time. It occurred in Holland during the early 1600s when speculation drove the value of tulip bulbs to extremes. At the height of the market, the rarest tulip bulbs traded for as much as six times the average person's annual salary. This was one of the most famous market bubbles of all time. It occurred in Holland during the early 1600s when speculation drove the value of tulip bulbs to extremes. At the height of the market, the rarest tulip bulbs traded for as much as six times the average person's annual salary.The tulip was brought to Europe in the middle of the sixteenth century from the Ottoman Empire. Holland's upper classes soon competed for the rarest bulbs as tulips became a status symbol. By 1636, tulip bulbs were traded on the stock exchanges, encouraging all members of society to speculate in the markets. Many people sold real investments and personal possessions to participate in the tulip market mania. At the beginning of 1637, some tulip contracts reached a level of about 20 times the level of three months earlier. A particularly rare tulip, Semper Augustus, was priced at 5,500 guilders per bulb - roughly the cost of a luxurious house in Amsterdam - just before the crash. Like all bubbles, it all came to an end in 1637, when prices dropped, and panic selling began. Bulbs were soon trading at a fraction of what they once had, leaving many people in financial ruin. George Soros Broke the Bank of England  Soros crashing the British Pound deliberately and made a fortune. September 16, 1992, is known as Black Wednesday – the day George Soros committed this crime. He made over £ 1 Billion in profits by short-selling the Pound Sterling. The UK Treasury spent £ 27 Billion of its reserves trying to prop up the currency. This was an outrage. The UK had to spend £ 27 Billion to defend its financial system for this criminal to make £ 1 Billion. Soros never went to prison. Instead, he has used his profits to finance liberal causes and crooked politicians that follow his Socialist agenda. Soros crashing the British Pound deliberately and made a fortune. September 16, 1992, is known as Black Wednesday – the day George Soros committed this crime. He made over £ 1 Billion in profits by short-selling the Pound Sterling. The UK Treasury spent £ 27 Billion of its reserves trying to prop up the currency. This was an outrage. The UK had to spend £ 27 Billion to defend its financial system for this criminal to make £ 1 Billion. Soros never went to prison. Instead, he has used his profits to finance liberal causes and crooked politicians that follow his Socialist agenda.The Hunt Brothers Create a Silver Mania  When H.L. Hunt died in 1974, he left his family billions. Two of his sons, Herbert & Nelson, put their oil money into the commodities market. They were big believers in silver, so instead of settling the futures contracts in cash, they took physical delivery & started buying silver. When H.L. Hunt died in 1974, he left his family billions. Two of his sons, Herbert & Nelson, put their oil money into the commodities market. They were big believers in silver, so instead of settling the futures contracts in cash, they took physical delivery & started buying silver.They stockpiled this silver and used their vast cash reserves to buy silver futures (bets that silver would rise in price). The billions in demand created by their manipulation triggered the rise of silver from $4.39 to more than $50 per ounce. $1 billion worth of silver purchases was bound to move the market, but the Hunts were able to increase this by leveraging the family fortune many times over. The Hunt name was considered as good as gold, & the Hunts were able to get capital at much lower rates than other speculators. The Hunt brothers had already considerably reduced the amount of silver available on the market, and this made their continued buying all the more potent by pushing up the price of silver. The Hunts' position was now worth around $4.5 Billion. People were pawning coins and silverware to take advantage of the high price of silver, but the brothers now controlled over two-thirds of the US silver market. The US government became concerned over manipulation of the nation's silver reserves & the fact that it involved Saudi royalty. So federal commodities regulators wrote special rules to prevent any more long position contracts from being sold for silver futures. This suspended the fundamental rules of the market. With longs frozen, and shorts free to pile on, silver began to slide. Margin calls began to take a toll on the Hunts' reserves to the point where they were paying millions a day in costs. The final straw broke when it became clear that the government was after the Hunts' scalps. Their credit dried up. Concerns that the Hunts might not be able to meet margins with new loans, and would go under (pulling several brokerages and banks with them), put further downward pressure on the price of silver. On Thursday (today called Silver Thursday), March 27, 1980, the Hunt brothers finally missed a margin call, and the market plunged. Silver dropped to less than $11. Collectibles Can't be: 1) Pumped and Dumped 2) Shorted 3) Optioned 4) Manufactured 5) Sold by IPO 6) Manipulated! There are no Arbitrageurs, Wild Speculators, or Day Traders Among Collectors. It is impossible to crash the collectibles markets by flooding them with too much supply. Because they cannot be manipulated like other financial markets, they are considered the safest of investments. A Market Dominated by Very Wealthy  There have always been wealthy investors in collectibles. In fact, the first formal rare coin market open to the public started in London in the early 1600s. But for thousands of years before that, the royalty had invested in coins. Collectibles were the only asset class that rose during the Great Depression. As a result, there were more millionaires created during the Depression than at any time in US history. There have always been wealthy investors in collectibles. In fact, the first formal rare coin market open to the public started in London in the early 1600s. But for thousands of years before that, the royalty had invested in coins. Collectibles were the only asset class that rose during the Great Depression. As a result, there were more millionaires created during the Depression than at any time in US history.It is good that the wealthy buy collectibles because they keep the market strong. This concept is also understood by successful stock market investors. Wise stock buyers don't buy thinly traded stocks that are purchased only by small day traders. They want stocks that have at least 50% "institutional sponsorship," meaning that the majority of a company's stock is owned by large institutions that are unlikely to panic at the first sign of trouble. Day traders tend to dump stocks in a matter of seconds of a negative rumor. Fortunately the fact that the wealthy invest in collectible coins helps keep the market stable so that smaller investors can participate in the gains. Individual investors can buy rare coins for as little as a few thousand dollars - in some cases just a few hundred dollars over the "spot" price of bullion coins, which are mass-produced and therefore possess no rarity. Sophisticated Markets Price guides and sophisticated market information exist for an amazing variety of collectibles, not just rare paintings and antique furniture. Enthusiasts invest in Ming Dynasty vases, ancient Gold and Silver coins, beautiful tapestries, Persian rugs, porcelains, musical instruments, statues of all kinds, antique automobiles, and dozens of other valuable items. Less expensive collectibles can include coins that are minimally rare, comic books, stamps, baseball cards, movie posters, autographs, signed sports memorabilia, and much more. There are even markets for hospital bedpans and old duck decoys! The key to these is that they may be inexpensive when first purchased, but many later command huge prices. For instance, a Babe Ruth baseball card that was free in a three-cent pack of chewing gum recently sold for half a million dollars.  The Best are Mega Rarities! The Best are Mega Rarities!The point at which a collectible is considered very rare is different for each type of collectible. For example, coins or sets of coins are considered rare if 5,000 or less exist worldwide. Less than 1,000 is very rare. And less than 20 known is considered a Mega-Rarity. Mega Rarities are to collectibles what gormet food is to Burger King. If you can afford them, you will make far more money on them than less rare items. For instance, we obtained one of the rarest English coins in the world for one of my rare coin clients for over $600,000. Today it is worth triple that. A $10,000 coin would probably have made half that much in the same short period of time. Any collectibles dealer, regardless of his or her specialty, will tell you that the cardinal rule of collectibles is "Buy the best you can afford." Using coins as an example (since they are the only collectibles I personally buy), the potential gain on a $50,000 coin will almost always make you more money than two $25,000 coins, and far more than five $10,000 coins.  Most Wealthy People Collect Something: Most Wealthy People Collect Something:1) Rare Gold Coins 2) Antique Automobiles 3) Rare Tapestries 4) Ming Dynasty Vases 5) Antique Furniture 6) Rare Paintings 7) Oriental Rugs 8) Even Duck Decoys Most Regular People Collect Something:  1) Prints 2) Disney Keepsakes 3) Baseball 4) Cards 5) Comic Books 6) Sports Memorabilia 7) Odd Collectibles like bedpans How Collectibles are Evaluated and Appraised Expert appraisals of collectibles are expensive and time-consuming. Such assessments have a limited life, meaning that smart people won't buy based on an old evaluation. What is the antique Louis XV armoire was perfect when it was inspected, but was scratched in the interim? Or what if the Monet painting had been stored improperly and exposed to humidity, lowering its value? Most buyers will require a new appraisal, which can cost thousands of dollars. No Guarantees There are also no guarantees on appraisals. If the object turns out to be a fake, the appraiser might or might not return your appraisal fee. But he will never repay you for your losses caused by his incompetence. And the dealer who sold you the fake will be long gone. The only exception is rare coins. If the coins have been graded by the Professional Coin Grading Service (www.PCGS.com) or by the Numismatic Guaranty Corporation (www.NGCCoin.com), their work is guaranteed. If you look at their websites, you will see that they guarantee not only the authenticity of the coins they certify but also the grade they give it. (The grade is almost as important as the rarity of a coin.) This is a significant advantage. Numismatics (rarities) don't just offer universal grading and certification, but certification with meaning! If you buy any other collectible that is later determined to be counterfeit - tough luck. Only numismatic coins offer secure grading with a money-back guarantee of the actual value of the coin. Many Types of Collectibles are Great Investments; But Few of Them: 1) Are portable 2) Are concealable 3) Have intrinsic value 4) Have lasting certifications 5) Have universal grading 6) Have certification guarantees 7) Have real-time trading 8) Are liquid Portable and Concealable?  Not so much for most collectibles. If there is a major financial crash and it becomes unsafe or hard to get food where you are, you may want to head to the mountains. Would you want to drag along large paintings or an antique desk? Or would you prefer to put your net worth in your pockets, as you can do with rare coins? Not so much for most collectibles. If there is a major financial crash and it becomes unsafe or hard to get food where you are, you may want to head to the mountains. Would you want to drag along large paintings or an antique desk? Or would you prefer to put your net worth in your pockets, as you can do with rare coins?The same is true for hiding your valuables. If the US experiences hyper-inflation (as almost every nation in the world has), we will see gangs of guys with guns roaming the streets trying to steal whatever valuables they can find. It is very hard to hide most collectibles. It is very easy to hide small ones. A great historical example of this was when the Jews who realized what was coming left Germany before Hitler started rounding them up for extermination. They weren't allowed to bring anything of vlaue with them. But many sewed rare Gold coins in the hems of their clothes, and were able to cross the border without detecttion. Intrinsic & Extrinsic Value Only coins and diamonds possess both of these critical values. Intrinsic value is the value an item has regardless of its rarity. Gold and diamonds will always have this value because of their utility - they are critical to many types of industries. In very valueable items the intrinsic value is less important. For example, the 1849 US $20 Gold coin, the first $20 coin and the only one known to exist is valued at $20 Million. It's intrinsic (bullion) value is only around $1,580 - the current price of spot gold. Extrinsic Value Only Almost all collectibles have only the value of their rarity and condition. The only intrinsic value of comic books, autographs, and baseball cars is that they can be burned for heat - not a good use of their value. The same is true of the Mona Lisa, which is currently valued at $850 Million. Its intrinsic value is about $4 for the wood frame and the canvas. Extremely Liquid A typical collectibles auction may result in 50% or less of the listed items being sold. A significant exception is the numismatic collectibles market. Unless the seller has placed an unreasonable reserve (minimum) price on their coin, 99% of coins are sold by the end of the auction. Why Coins are the Best Collectibles; Only They Have it All: 1) Are portable 2) Are concealable 3) Have intrinsic value 4) Have lasting certifications 5) Have universal grading 6) Have certification guarantees 7) Have real-time trading 8) Are very liquid One Final Point The collectible coins market is the most actively traded collectibles market. Over $100 Million in collectible coins change hands every week. That’s $5 Billion every year – and climbing.

| ||||

Dr. Tom Barrett is a pastor, teacher, author, conference keynote speaker, professor, certified executive coach, and marketplace minister. His teaching and coaching have blessed both church and business leaders. He has been ordained for over 40 years, and has pastored in seven churches over that time. Today he “pastors pastors” as he oversees ordained and licensed ministers in Florida for his ministerial fellowship. Dr. Tom Barrett is a pastor, teacher, author, conference keynote speaker, professor, certified executive coach, and marketplace minister. His teaching and coaching have blessed both church and business leaders. He has been ordained for over 40 years, and has pastored in seven churches over that time. Today he “pastors pastors” as he oversees ordained and licensed ministers in Florida for his ministerial fellowship.He has written thousands of articles that have been republished in national newspapers and on hundreds of websites, and is a frequent guest on radio and television shows. His weekly Conservative Truth article (which is read by 250,000) offers a unique viewpoint on social, moral and political issues from a Biblical worldview. This has resulted in invitations to speak internationally at churches, conferences, Money Shows, universities, and on TV (including the 700 Club). “Dr. Tom,” as his readers and followers affectionately refer to him, has a passion for teaching, as you can see from his ministry website (www.ChristianFinancialConcepts.com); his patriotic site (www.ConservativeTruth.org); and his business site (www.GoldenArtTreasures.com). Tom's friend Dr. Lance Wallnau wrote of him, "Tom Barrett is a Renaissance man with a passion for subject matter ranging from finance to theology and American history." Visit Dr. Tom Barrett's website at www.DrTom.TV

|