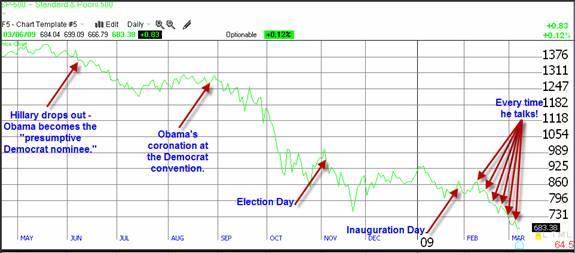

The Stock Market HATES Obama!March 9, 2009

I don't really need to say anything. This chart of the S&P 500 from last May to today says it all. But I will point out some important facts. Keep in mind that when I use the term "the market" I refer to real people making important financial decisions. The direction of the stock market is a composite of millions of decisions made by these people, most of whom understand the effects of political decisions on the financial markets. My background for commenting on the market consists of over 30 years as an investor and a financial professional. During that time I was a Branch Manager and a National Vice-President in the brokerage business, and I wrote a regular market commentary for Market Watch. As you can see in the chart above, during May, 2008 the market was flat, waiting to see whether Hillary or Obama would prevail for the Democrat nomination. From the time Hillary dropped out and Obama became the Democrat nominee the stock market began a free fall. There was still hope that McCain - a fiscal conservative - would win, but all the polls indicated that Obama would probably gain the White House. And the market didn't like that idea at all. Since that day the S&P 500 has dropped a record 50%! Never in the history of our nation has one man had such a negative effect on the stock market. And this has happened in less than a year. Since Obama's coronation at the Democrat convention August 26, the market has dropped 46%. Since Election Day it has crashed 32% - in just four months. And in the six weeks since Inauguration day, the S&P has plummeted an astounding 15%. I checked back for 100 years, and there has never been a drop like that following an Inauguration. The worst was less than half of Obama's drop. No matter how bad the country expects a new president to be there is always a degree of optimism when he takes office, based on the hope (often false hope) that he won't be as bad as his promises. In Obama's case, the hope faded fast. Those who voted for Obama would undoubtedly say that the market always goes up and down. That's right - up AND down. In Obama's case it has only been down. And it has gone down far more than in any similar period. Why do you think that is true? Every president since FDR has seen the market rise over their term or terms - except Richard Nixon and Jimmy Carter. The market dropped during Nixon's and Carter's presidencies because they did stupid things that made Americans lose confidence - just as Obama has done. President Bush inherited a recession from Bill Clinton, but you didn't see him crying about it. He gave America confidence. Then we were hit by the worst disaster in our nation's history - 911. In addition to the emotional devastation, the attack brought horrendous financial upheaval. Whole sectors of the market were crushed. Add to that the tremendous costs of the War on Terror, and you had the makings of a financial tsunami. But Bush, bless his heart, encouraged us in his quiet folksy way, and we did great economically. And the market rose 20% during his eight years in office. The market is influenced much more by words than it is by numbers. Those who invest know that if the people are confident the country will prosper. And if they are beaten down by negativity the opposite will occur. Obama has been beating us down since he started to run for office. He talked the economy down so much that it went down. For some reason he felt that the only way he would get elected would be if he campaigned on doom and gloom. He repeatedly talked about "eight years of a bad economy" until people started to believe it. Apparently he doesn't realize that he is supposed to be governing now, because he is still campaigning. He's still talking the economy down and telling America that things are going to get worse. His favorite words are "Crisis!" and "Catastrophe!" He has also grown inordinately fond of "the Great Depression." (What was so great about it, anyway?) But mainly he realizes that the stupid economic moves he has made are probably going to backfire, so he whines every day that the current economy is all Bush's fault. Contrast this with the way Ronald Reagan handled the fallout from Jimmy Carter's years of taxing and spending. Carter spent money the country didn't have and crushed businesses and individuals with unconscionable taxes. Reagan faced a looming economic crisis when he was inaugurated, but he didn't cry either. He cut taxes and spending, and with his great confidence in America, he made us proud to be Americans again. And it worked. The economy recovered and the stock market gained 61% while he was in office! Some argue that the credit crisis has weakened the economy, and that therefore the current crisis is not of Obama's doing. I disagree. The credit crisis has been looming over us for more than 30 years, but the crisis of confidence that Obama has created allowed the credit crisis to break out. Let me explain it like this. You can carry a disease in your body for many years as long as your immune system is in good shape. But if something happens to weaken your immune system, the disease can break out and incapacitate you in short order. Jimmy Carter laid the groundwork for the credit crisis over 30 years ago when he started forcing mortgage companies to give mortgages to unqualified people who couldn't pay them. Clinton made a bad situation worse by expanding Carter's programs. Under Clinton people with a history of not paying their bills were given no money down mortgages and only had to pay interest on their loans - because they couldn't make their payments any other way. Early in its first term the Bush Administration warned that the situation was getting bad, and argued for tighter mortgage qualification rules. John McCain led the Republican fight for stronger regulation. The Democrats blocked every attempt to halt the corruption at Fannie Mae and Freddie Mac. (Look at this video of Congressional hearings if you don't believe this: http://www.youtube.com/watch?v=Yga7TlsA-1A.) They cursed at and insulted the regulators for doing their job. And they accused Republicans of trying to "lynch" Franklin Raines, the corrupt CEO of Freddie Mac. (Raines has since been forced out of office and fined for falsifying records and for giving himself huge bonuses when the company was in financial trouble.) But note that the credit crisis did not break out while Bush was in office, for the simple reason that the market had confidence in him. The market clearly signaled that it had no confidence in Obama by dropping five per cent PER DAY the first two days after he was elected, and dropping almost every day for the next two weeks. He might have gained the confidence of the market if he had restrained himself from doing some very stupid things. In just six weeks he raised taxes on the small business that create over 90% of new jobs; raised capital gains taxes on investors who provide capital to those businesses; and guaranteed that we will have runaway inflation by printing trillions of dollars of money that is backed by absolutely nothing. And those are just the first three items on a list of twenty actions that Obama has taken that will hurt the economy, and that therefore the market hates. There are two things the stock market hates - uncertainty and a lack of confidence. Whenever there is uncertainty, the market falters. It would rather have bad news than to be left in the dark. And one of the main things analysts look at is the Consumer Confidence numbers. Obama has given the market massive doses of uncertainty since he was elected. He throws out plans on massive spending programs that haven't been thought out, so he can't give details. And the market goes crazy. I watch a live chart of the market every time Obama or his tax criminal Treasury Secretary speak about their plans. The market drops every time. As to Consumer Confidence, Obama has crushed every scintilla of confidence the public had with his famed eloquence. Every time the market starts to gain a little confidence, Obama opens his mouth and crushes it again. So since Obama has shoved the two things the market hates down the market's throat, the market now has a third thing it hates - Obama!

| ||||

Dr. Tom Barrett is a pastor, teacher, author, conference keynote speaker, professor, certified executive coach, and marketplace minister. His teaching and coaching have blessed both church and business leaders. He has been ordained for over 40 years, and has pastored in seven churches over that time. Today he “pastors pastors” as he oversees ordained and licensed ministers in Florida for his ministerial fellowship. Dr. Tom Barrett is a pastor, teacher, author, conference keynote speaker, professor, certified executive coach, and marketplace minister. His teaching and coaching have blessed both church and business leaders. He has been ordained for over 40 years, and has pastored in seven churches over that time. Today he “pastors pastors” as he oversees ordained and licensed ministers in Florida for his ministerial fellowship.He has written thousands of articles that have been republished in national newspapers and on hundreds of websites, and is a frequent guest on radio and television shows. His weekly Conservative Truth article (which is read by 250,000) offers a unique viewpoint on social, moral and political issues from a Biblical worldview. This has resulted in invitations to speak internationally at churches, conferences, Money Shows, universities, and on TV (including the 700 Club). “Dr. Tom,” as his readers and followers affectionately refer to him, has a passion for teaching, as you can see from his ministry website (www.ChristianFinancialConcepts.com); his patriotic site (www.ConservativeTruth.org); and his business site (www.GoldenArtTreasures.com). Tom's friend Dr. Lance Wallnau wrote of him, "Tom Barrett is a Renaissance man with a passion for subject matter ranging from finance to theology and American history." Visit Dr. Tom Barrett's website at www.DrTom.TV

|